Search

close

Stay in the loop with our monthly newsletter, bringing you a fresh take on all things property.

Form funnels into a Pardot list to update Prospect sign up for Estate Agent and New Homes

"*" indicates required fields

Annual rental inflation for new lets, UK

Year-on-year change in rental demand

Rented homes in >£1000pcm markets

"The rental supply/demand imbalance has started to narrow but is far from closed. Rents for new lets will continue to rise over 2024, albeit at a slowing rate. Only a rapid expansion in supply will start to improve affordability for UK renters."

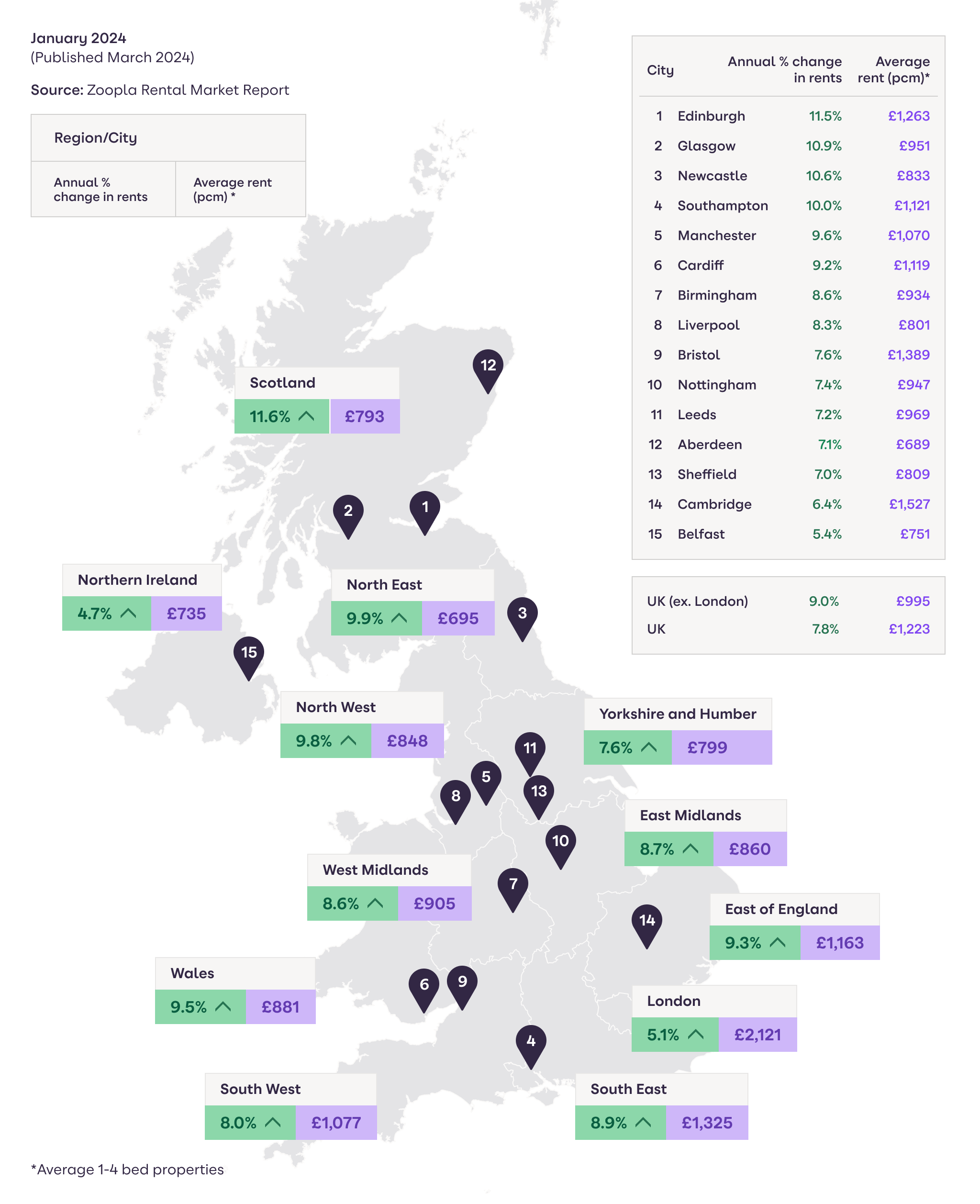

The heat is finally coming out of UK rental inflation which has slowed to 7.8%, down from 11% a year ago – the lowest rate for 2 years. The average UK rent is now £1,223 per month.

The moderation in rental inflation is down to weakening demand and growing affordability pressures, rather than major expansion in supply. Levels of new investment by private landlords remain low.

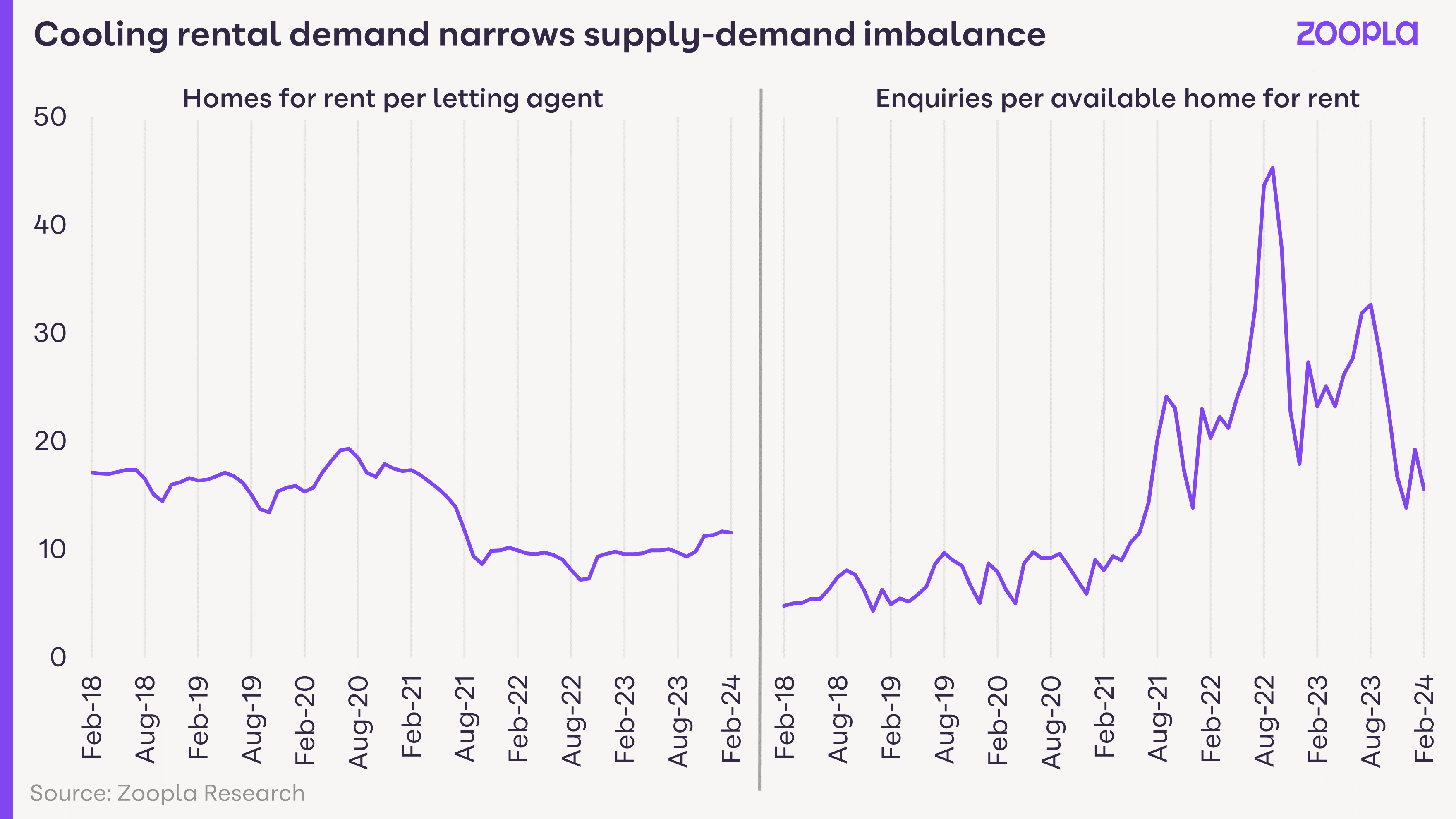

The average letting agent has now 12 homes for rent – this is a fifth higher than last year but 28% below the pre-pandemic average (16).

Demand for rented homes has fallen by a fifth over the last year as one-off pandemic factors recede, the labour market cools, and lower mortgage rates support first-time buyers.

However, there remain more than 15 enquires for every home for rent – this is down from over 40 enquiries in 2021 but still double pre-pandemic levels.

The supply/demand imbalance is narrowing but is far from closed. Rents will continue to rise over 2024, albeit at a slowing rate.

London has recorded a sharp slowdown in rental inflation to just 5.1%, down from 15.3% a year ago. The balance between supply and demand has narrowed the most in London, with demand 30% lower than a year ago and available supply increasing by the same amount.

High rents in London mean affordability constraints are compounding the scale of the slowdown in rent inflation.

Across the rest of the UK, rental inflation is broadly in line with a year ago despite weaker demand. Rental inflation is starting to slow across all major cities but to a lesser degree than London.

Rents continue to rise the fastest in Scotland (11.6%) – the only area where rental inflation remains in double digits. The rate of inflation has slowed modestly on cooler demand, mainly due to seasonal factors, but lower rents are less of a constraint on rental growth.

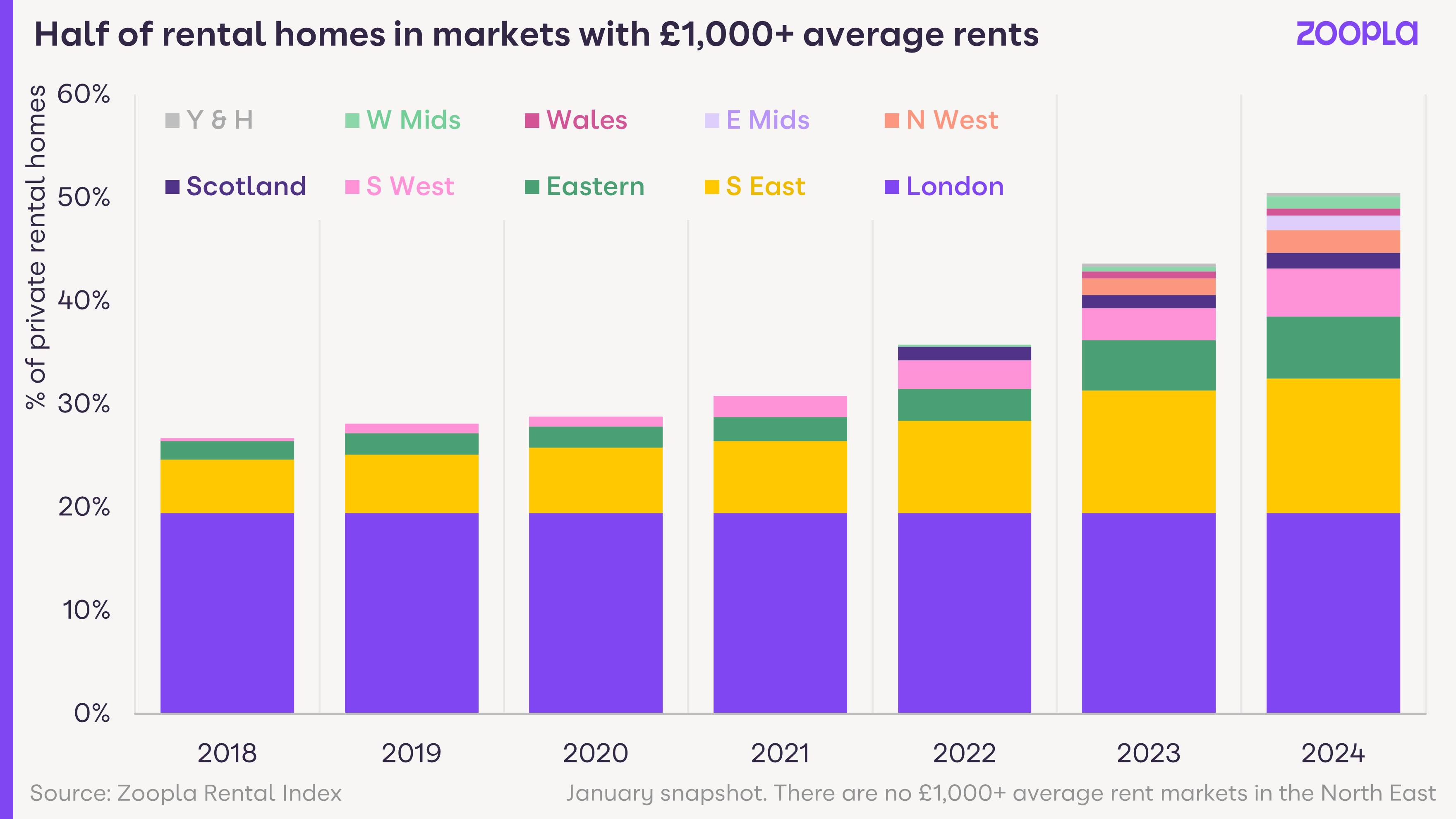

The pandemic years have driven a step change in rents which have jumped 29% higher since January 2020. This has pushed many more rented homes into the higher rental brackets.

Analysis of average rents by local authority reveals that over half of rented homes (51%) are now in markets with average rents of over £1,000 per month – almost double the level five years ago.

Rents in southern England have been close to, or above, the £1,000pcm level for some time and faster rental inflation has simply pushed more areas over this threshold.

Nearly all private rented homes in the South East are in areas with average rents over £1,000pcm, compared to less than half in 2020.

In the East of England it’s 70% today compared to 24% in 2020. Over half of rented homes in the South-West are above this level.

The growth in £1,000pcm areas is now expanding in regional markets outside the south of England as new city centre rental markets emerge. The rise of corporate and institutional investment in rented homes has led to the delivery of over 90,000 new ‘build to rent’ homes across the UK in recent years with more to come.

Housebuilders are also starting to sell homes to corporate landlords. We find that a fifth of rented homes in Scotland, the North West, East Midlands and West Midlands are now in areas over £1,000pcm.

No local markets had rents over £1,000pcm outside the south of England just 3 years ago. The North East is the only area with no markets over this level, while Yorkshire and the Humber has just 4%.

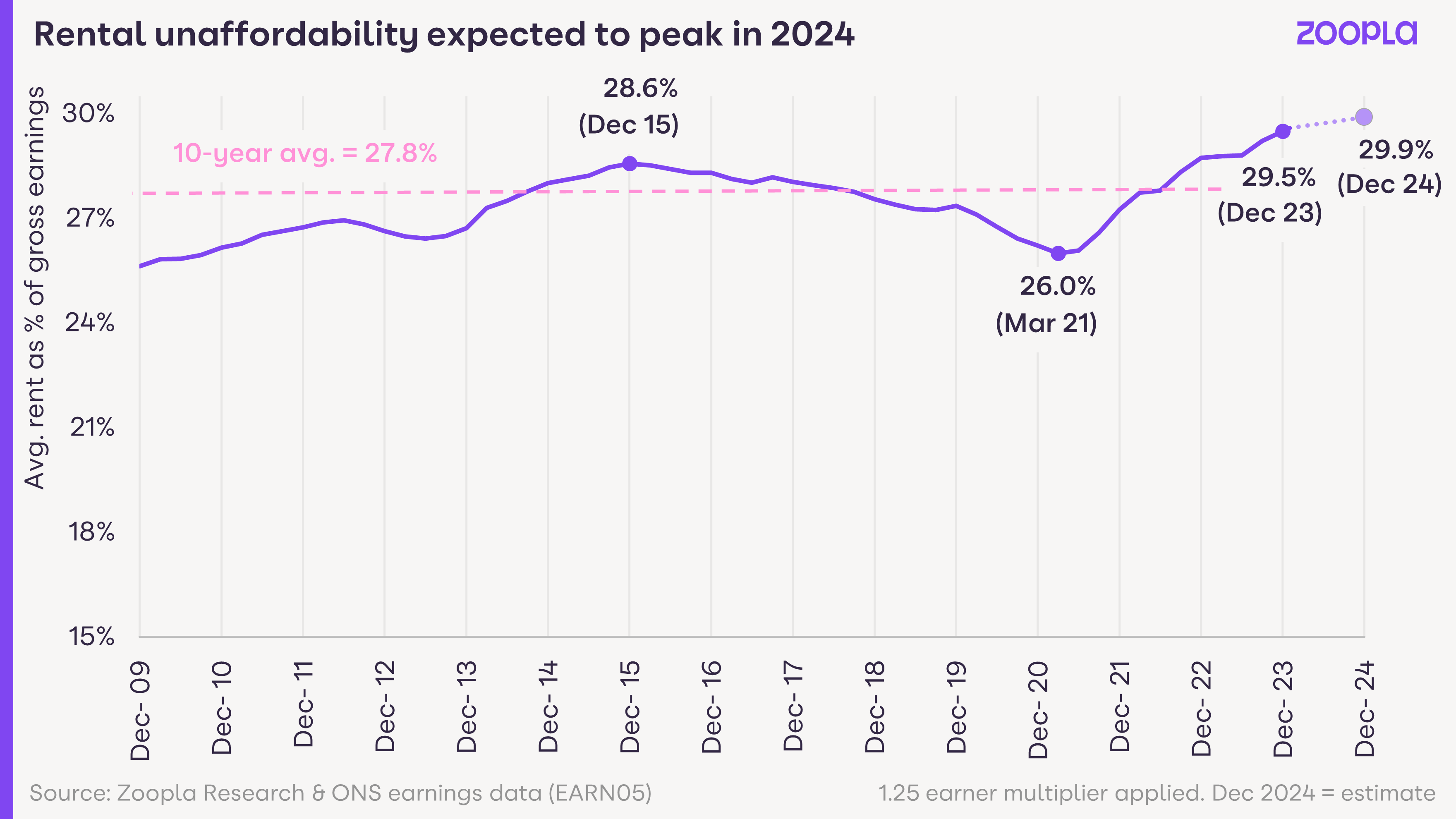

Rents for new lets have been rising faster than average earnings for over 2 years, since October 2021. This has taken our measure of rental affordability to a high of 29.5% of gross earnings at the end of 2023.

Rental affordability improved between 2016 and 2021 on the back of low rental inflation, with rents rising by just 4% over these 5 years – a result of 1) weaker demand post Brexit, 2) growth in supply pre-2016, and 3) easier access to home ownership thanks to low mortgage rates.

In contrast, recent years have been marked by strong demand, no increase in rental supply and high mortgage rates making it harder for first-time-buyers to access home ownership.

This has widened the supply/demand imbalance, pushing rents for new lets up faster than earnings, which has led to a deterioration in rental affordability.

Looking ahead, we projected UK rental inflation would halve over 2024 to 5%. The consensus among economic forecasters is that the average earnings growth will slow to just below 4%. It means no immediate prospect that rental affordability will improve over 2024.

A sustained expansion in available supply would drive a faster slowdown in rental inflation than we might expect. It’s likely to result in rents falling in some city centre locations. This may well happen in 2024 but not on a scale that would impact the headline growth rate.

Ongoing low levels of net new investment means below average levels of rental supply are set to persist, supporting headline rental inflation.

The clear conclusion is that the best way to improve affordability is to boost rental supply. More supply will continue to come from the new build sector, but the big needle mover would be more investment by private landlords.

This is currently looking unlikely and further rationalisation of landlord portfolios in the face of higher mortgage rates and growing regulation will offset any increase new investment in rental supply.

UK house prices increase 1.6% as tariffs, stamp duty changes and broader economic uncertainty dampen buyer demand

House price inflation slows to 1.8% as the supply of homes for sale outpaces the growth in sales agreed

The housing market gets off to its strongest start in three years, with new sales agreed up 12 per cent on 2024.