Search

close

Stay in the loop with our monthly newsletter, bringing you a fresh take on all things property.

Form funnels into a Pardot list to update Prospect sign up for Estate Agent and New Homes

"*" indicates required fields

Annual rental inflation for new lets, UK

Increase in annual average rental costs since 2021

Demand for renting compared to pre-pandemic levels

“Rental market and London lagging while rents rise in more affordable areas conditions are improving, but the supply/demand imbalance is set to remain over 2025. Affordability will limit rental inflation in areas with high rents, but there is room for rents to rise faster than earnings in more affordable areas over 2025.”

UK rents have increased by 3.9% in the 12 months to October 2024, down from 9.1% a year ago and averaging at £1,270 per month. This is the lowest growth rate for over 3 years (August 2021) and the first time that earnings are rising faster than rents since September 2021.

Rental growth is slowing as the imbalance between rental supply and demand narrows, with the supply of homes for rent slowly

recovering. The average agent has 12% more homes for rent than last year, but this is still a fifth (18%) lower than pre-pandemic levels.

Demand for rented homes is 29% lower than last year as one-off pandemic factors fade and migration for work and study slows. However, enquiries for rented homes remain nearly a third (31%) higher than pre-pandemic levels.

We expect the mismatch between supply and demand to continue over 2025, keeping a steady upward pressure on the cost of renting. However, growing affordability constraints in areas with high rental costs will help to moderate the pace of rental inflation over 2025.

Rents have out-paced the growth in average earnings over the last 3 years. Rents for new lets are £270 per month higher than 3 years ago, adding £3,240 (27%) to the annual cost of renting since 2021.

Average earnings have grown 19% over the same period.

We expect affordability pressures to limit rent rises in the areas where rents have increased the most – and where they are most expensive – typically in London and other major UK cities. There remains headroom for rents to rise in more affordable areas in 2025.

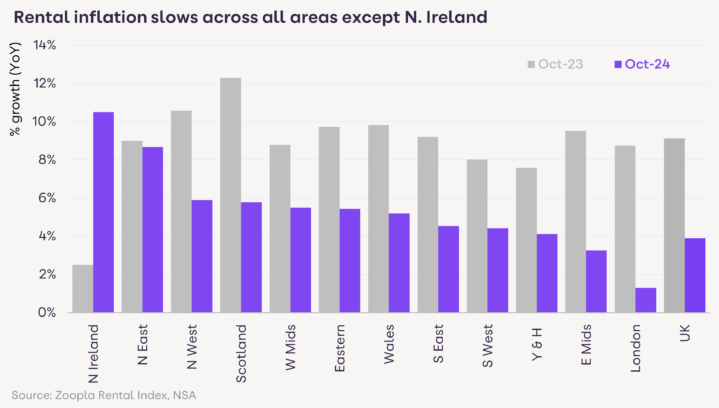

Rental inflation has slowed across all regions and countries over the last 12 months apart from Northern Ireland, where they are rising off a low base on stronger economic conditions.

London has recorded the greatest slowdown, with average rents 1.3% higher over the last year, down from 8.7% a year ago. London also has the highest rents, averaging at £2,190 per month. Rents are rising the fastest in Northern Ireland (10.5%) and the North East (8.7%) – the two areas with the lowest average rents.

With more renters than there are homes to rent, people are seeking out the best value for money. This means the impetus for rental inflation is generally being driven from markets with lower rental values. We also see evidence that, within cities, rents are typically rising faster at the lower end of the market.

In London, rents are 3-6% higher over the last year in lower-value areas of outer London, led by Havering (5.9%) and Barking & Dagenham (5.2%). Rental inflation is less than 1% in inner London areas, led by Kensington & Chelsea, Greenwich and Tower Hamlets.

Outside of London, rents are rising fastest in Rochdale (11.9%), Blackburn (10%), Birkenhead (9%) Burnley (8.9%) and Newcastle (8.7%). This largely reflects ‘catch-up’ rental growth as renters seek out areas with better value for money in and around major cities.

Changes in rents at the local level reflect local patterns of demand and supply. Rental growth has stalled in Nottingham, for example. It is the only city where the supply of homes available to rent has jumped over the last year, providing renters with more choice. Rents are unchanged over last year, down from +10.4% growth a year ago.

While the number of homes available to rent is higher than this time last year, we don’t expect there to be any big increase in rental supply over 2025. The stock of homes for rent remains below pre-pandemic levels in all areas apart from the East Midlands.

Private landlords continue to sell off rented homes at a steady pace in the face of greater regulation and higher borrowing costs, despite what have been sizable increases in rents. One bright spot has been more corporate investment in new build rented homes – but even in these instances, the pace of new development has slowed in the face of higher borrowing costs and more regulation.

We believe that the peak of the private landlord sell-off is now behind us. It’s now a question of when market conditions look right for landlords to increase investment and expand rental supply. This is still some way off and requires lower base rates and higher yields.

Demand for privately rented homes will continue to be supported by a range of factors including 1) the unaffordability of homeownership for first-time buyers, 2) migration for work and study and 3) low growth in the size of the social rented sector. One-off pandemic factors that drove the boom in rental demand in 2022 are now behind us, and tighter visa rules are starting to reduce the pressures from higher levels of migration.

The real challenge continues to be faced by renters on lower to middle incomes who can’t access social or affordable housing and need to rent privately. Almost 30% of private renters receive full or partial support for rental costs via Universal Credit. The 1.5m new-build homes target is a welcome ambition and the country needs a major expansion in the number and availability of rented homes of all tenures. Private landlords will continue to play a critical role in supporting rental supply.

We expect rents for new lets to increase by 4% over 2025, at a faster rate than the 2.5% growth in average house prices. Rents are set to outpace capital values for the next 3 years, boosting yields further.

The impetus for rental growth will come from areas where rents are cheaper and have headroom for above-average growth, including rural areas and smaller towns well-connected to larger cities – where rents are already rising more quickly.

We expect rental inflation in London and larger cities to lag the UK average, mainly because of growing affordability pressures and further modest growth in supply.

Lower mortgage rates have also played a role in stimulating more demand from first-time buyers (FTB) in the sales market, most of whom move from rented homes. Stronger FTB demand in 2024 is one of the factors behind weaker rental demand. We expect FTB demand in the sales market to remain robust over 2025, which will keep rents in check at the middle to upper end of the market.

One important point to note is that there are different measures of rental inflation. While the Zoopla index for new lets is registering the lowest rate of rental inflation for 3 years, the ONS private rental index is running at 8.4% with inflation of over 10% in London.

The Zoopla ‘new lets’ index tracks rents when homes become vacant and re-let at the open market rent. This applies to c.25% of homes per year. The ONS index tracks rents across the whole market, covering the 25% of new lets in addition to the 75% of homes where renters aren’t moving, and where the rent may have not increased at all.

Using the bathtub analogy, Zoopla’s new let index tracks the temperature of the hot water flowing into the bath, while the ONS tracks the temperature of the water in the bath.

The rate of inflation recorded by the ONS index tends to lag that recorded by new let indices. It can take 2-4 years for increases in rents to spread across the whole market. This explains why the ONS index is recording higher levels of rent inflation. Both are valuable for different purposes and it’s important to use the right index when setting rent levels.

Note: The Zoopla rental market index is a repeat transaction index, based on asking rents and adjusted to

reflect achieved rents. The index is designed to accurately track the change in rental pricing for UK housing.

UK house prices increase 1.6% as tariffs, stamp duty changes and broader economic uncertainty dampen buyer demand

House price inflation slows to 1.8% as the supply of homes for sale outpaces the growth in sales agreed

The housing market gets off to its strongest start in three years, with new sales agreed up 12 per cent on 2024.