Search

close

Stay in the loop with our monthly newsletter, bringing you a fresh take on all things property.

Form funnels into a Pardot list to update Prospect sign up for Estate Agent and New Homes

"*" indicates required fields

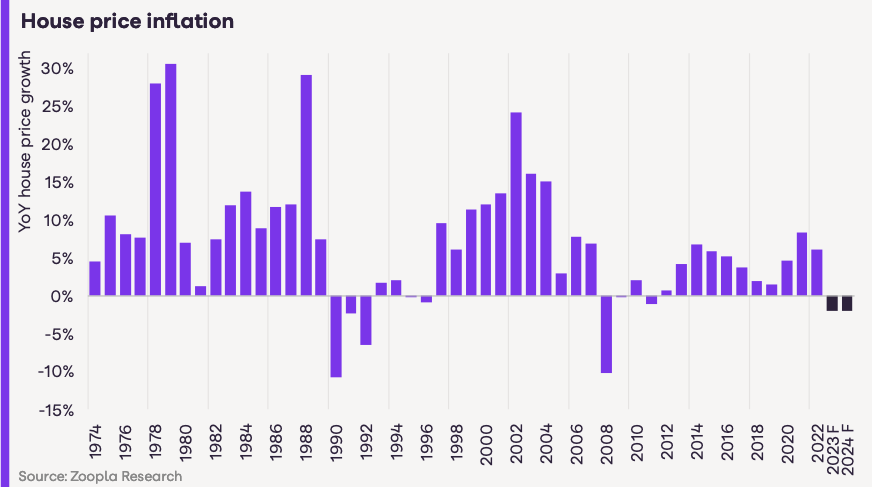

Current UK house price growth (YoY)

House price inflation over 2024

Housing sales in 2024

Our forecasts for the housing market were more optimistic than many others a year ago and it looks like we called it right. However, lower house price falls over 2023 mean the adjustment to higher mortgage rates will run into 2024, unless mortgage rates fall more quickly than currently expected

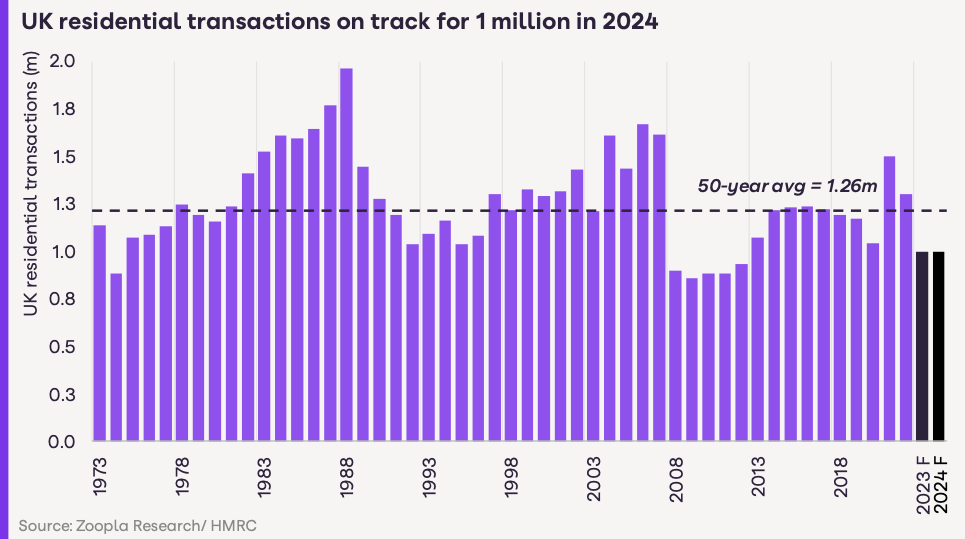

This month’s report focuses on the outlook for 2024 as the housing market continues to adjust to higher mortgage rates. It’s not a quick transition. House price falls have been modest over 2023, compared to a 20% reduction in buying power. Mortgage rates look set to remain higher for longer into 2024, meaning income growth will be the main factor to reset housing affordability and support sales. Our 2023 forecasts look spot on with 2 months to go – transactions of 1 million and house price falls of ‘up to 5%’.

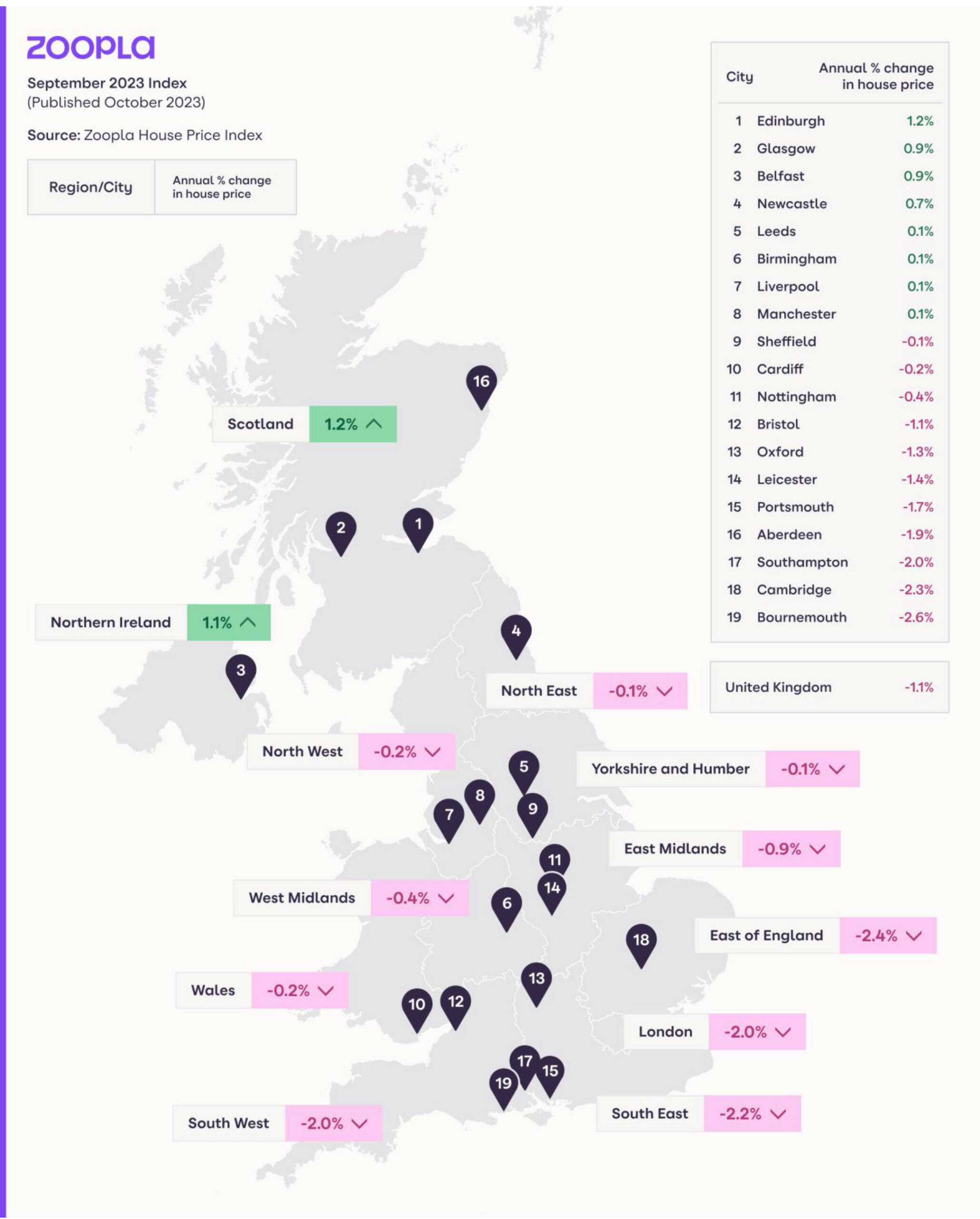

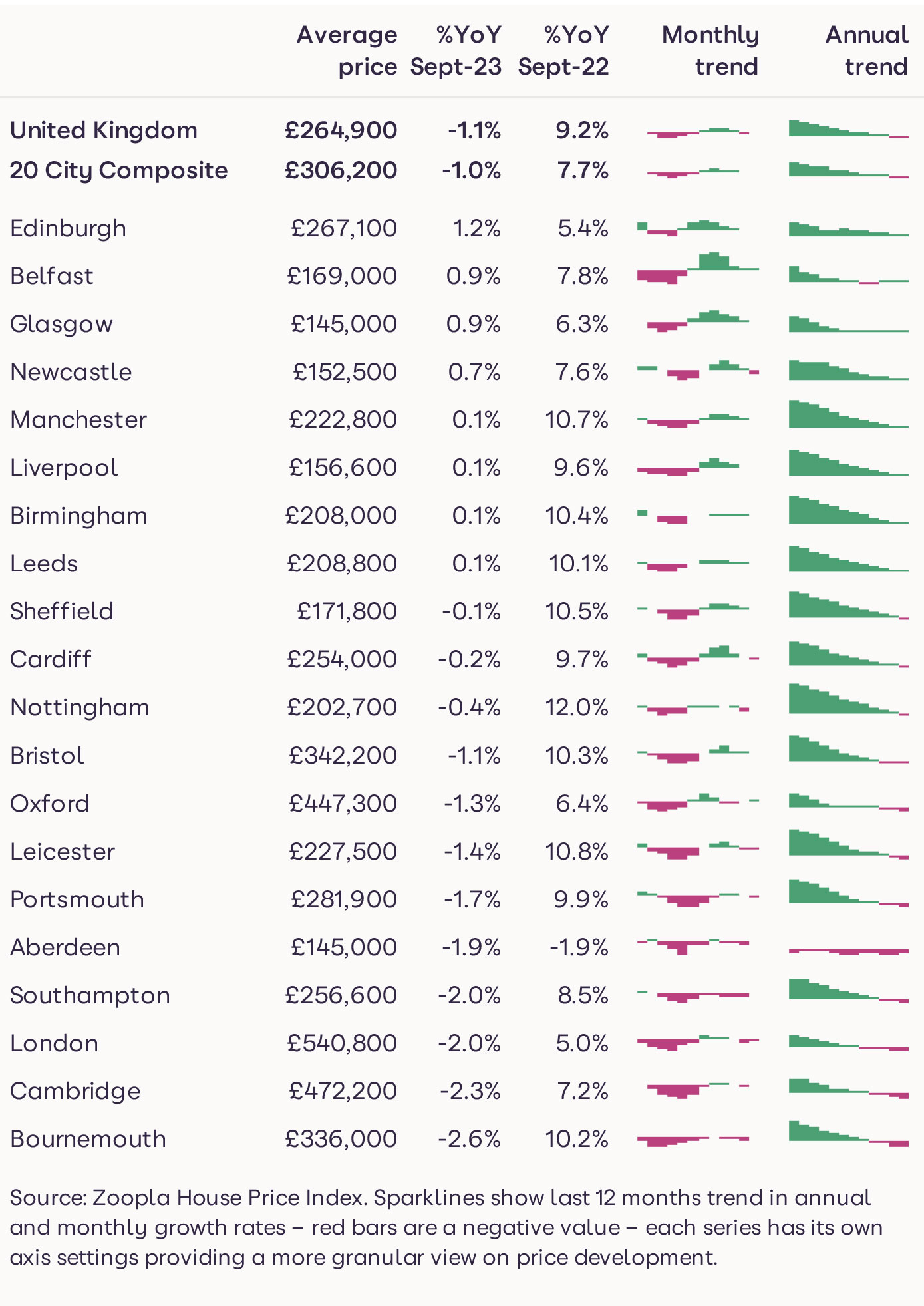

Higher mortgage rates and the cost-of-living squeeze have hit buyer demand. The first half of 2023 registered a rebound in demand as mortgage rates fell towards 4%. A jump in borrowing costs over the summer has reduced demand once again. It is a fifth lower on an annual basis and 25% below the 5-year average for October. The result has been a rapid slowdown in price growth from +9.2% a year ago to -1.1% today. Other indices, based on mortgage lending, have registered larger annual falls, while the ONS’ House Price Index was +0.2% in July.

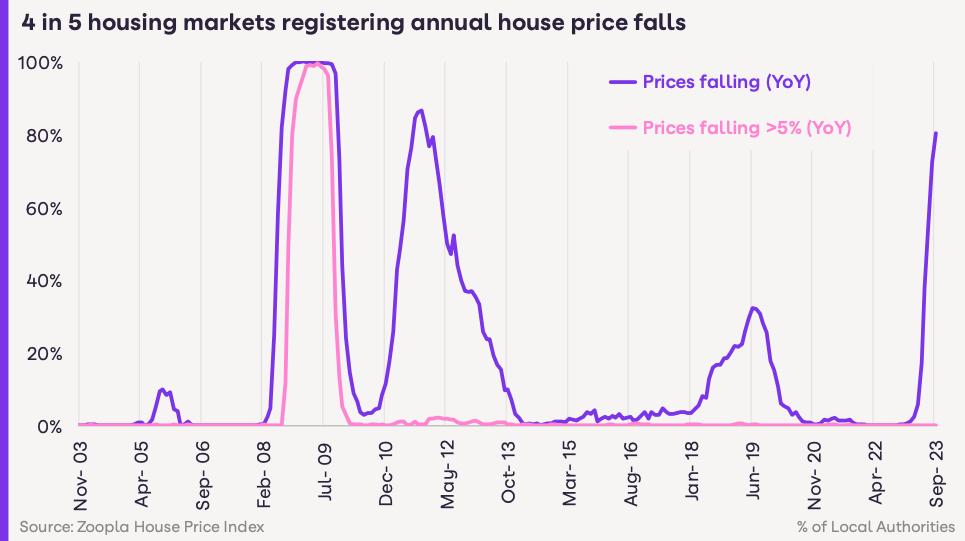

Southern England has been at the forefront of price reductions to date, but these are now spreading further afield. Our localised house price indices1 show that 4 in 5 housing markets are registering annual price falls, up from less than 1 in 20 just six months ago. The scale of price falls is modest, limited to very low single digits. No markets are registering annual price falls over 5%. We expect to start seeing some markets register annual price falls over 5% in the coming months as pricing continues to adjust in the face of weaker buying power.

The largest annual price falls at a larger, postal area level, are recorded in Colchester (CO) where prices are 3.5% lower over the year. This is followed by Canterbury, Luton and Brighton – all London commuter areas. Prices in Halifax (HX) are 3.6% higher than a year ago and 2.4% higher in the Motherwell (ML) postal area in Scotland.

House prices have defied predictions of much larger falls in 2023. The economy continues to grow, albeit slowly, while unemployment remains low and incomes are increasing. Lenders are supporting customers to refinance, limiting the number of forced sellers.

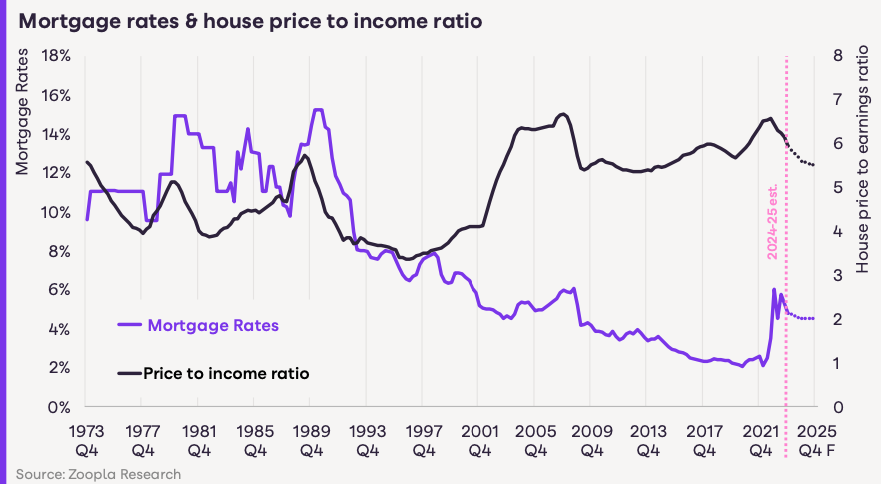

Tougher mortgage affordability testing since 2015 has also built resilience into the market. This stopped households using ultra-cheap mortgage rates to take on unsustainable levels of debt. In the past this would have pushed house prices much higher, making double- digit price falls far more likely once demand fell.

While new mortgaged buyers may have been paying just 2% for their mortgages, they still had to prove to their bank they could afford a 7% rate. This means most mortgaged buyers can afford higher rates as they remortgage. However, banks are currently stress testing new borrowers at 8-9%, even though the borrower is paying 5%, which is compounding the reduction in buying power and hitting sales.

The market remains on track for a 23% drop in home moves over 2023 to 1 million. Many households are delaying moves or simply unable to afford to buy at 5%+ mortgage rates. The decline in sales is broadly uniform across regions and property types.

A recent survey of households by Zoopla found an increase in people ‘less eager to move’, citing uncertainty and expectations that prices could fall further. However, half of respondents said that their moving expectations had not changed, while 15% were more eager to move.

Looking to next year, we expect the usual seasonal rebound in demand next spring as pent-up demand returns to the market. However, the current pipeline of sales is lower than this time last year. General elections also tend to create a pause in activity which is why we expect another year with 1m home moves in 2024. We may see more sales if mortgage rates fall back towards 4% more quickly.

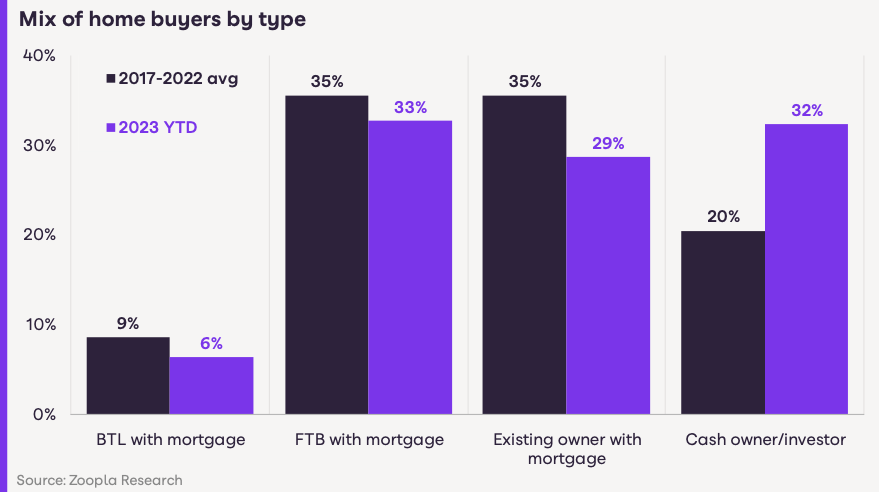

Higher mortgage rates have hit the number of moves by mortgage- reliant borrowers. The number of cash sales is holding steady. First- time buyers (FTB) look set to be the largest buyer group in 2023, closely followed by cash buyers. Over the last 5 years, cash buyers have accounted for 1 in 5 sales, rising to 1 in 3 sales in 2023.

FTB’s share of sales is down on recent years but still holding up as the rapid growth in rents continues to support demand. In markets with cheaper house prices, FTBs’ mortgage repayments are lower than rental costs – even at 5.5% mortgage rates.

It’s clear from our recent consumer survey that there are parts of the population that remain keen to move. However, they have been biding their time in 2023 and waiting for the outlook to become clearer – in particular, the likely trajectory for mortgage rates and house prices.

The risk of a major collapse in prices is becoming less of a concern, meaning home buying decisions hinge more on the financial ability and willingness of people to move when mortgage rates are in the 4- 5% range. It’s unclear how many people are hoping and/or waiting for mortgage rates to get even lower again. At the same time, household finances have been under pressure from rising living costs and inflation eroding any growth in incomes. This is now reversing at last and real income growth is important to support demand.

We expect cash buyers to remain a larger buyer group in 2024, along with FTBs as rents continue to rise at a rapid pace. Higher mortgage rates tend to impact upsizers more than most, as they buy bigger homes and require larger mortgages. Upsizers need to become more flexible about what they want to buy and where – households tend to be fixed on where they want to buy next when there are other areas that may meet their needs. If we see more upsizers in the market in 2024, this would support overall sales volumes.

While the likelihood of a double-digit price drop remains low, housing affordability needs to improve to bring more buyers back into the market and support sales volumes. Households also need to feel more confident in the economic outlook. UK house prices have fallen less than we expected over 2023. Together with 5% mortgage rates, it means UK housing remains relatively expensive at the end of 2023.

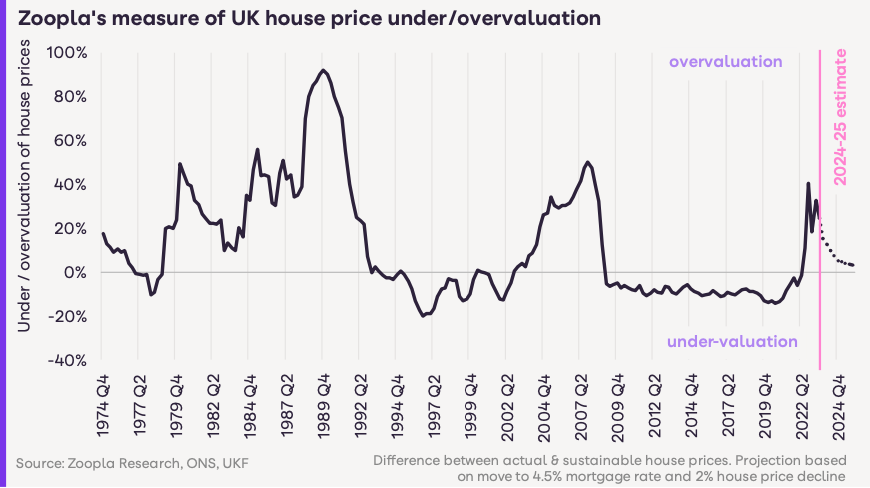

The chart below plots our measure for how much house prices are over- and undervalued over time. It’s a conservative assessment and is calculated on our estimate of what an average UK household could afford to spend on a typical home compared to actual prices. It shows periods of overvaluation in the late 1980s and again in the run-up to the global financial crisis in 2007, after which house prices fell over the subsequent recessions.

The jump in mortgage rates over the last 18 months has been the primary driver of the current overvaluation in home values. House prices need to fall further, and incomes increase, or mortgage rates need to fall further to reset affordability and support demand or sales.

In our projections, we assume mortgage rates will fall to 4.5% by the end of 2024 and remain at that level into 2025. Our expectation is that UK house prices will fall by an average of 2% over 2024. The number of homes for sale is at a 5-year high, meaning sellers will need to price competitively if they are serious about selling. This is likely to keep pricing under pressure.

Faster growth in household incomes in 2024 will support affordability but leave housing slightly overvalued at the end of 2024. Households taking longer mortgage terms would remove this overvaluation. The outlook really hinges on the trajectory for mortgage rates and how lenders assess affordability over 2024. The Bank of England is projecting inflation to fall to its target in H1 2025 so mortgage rates falling faster in 2024 would support sales and pricing.

The housing market is adjusting to higher borrowing costs through lower sales rather than a big decline in house prices. Asset prices around the world are also adjusting to higher borrowing costs. There is an active debate in financial circles about the long-run outlook for borrowing costs, which sets the outlook for UK mortgage rates. Most agree we aren’t returning to the years of very cheap borrowing as central banks sunset policies that created cheap money to support economies after the global financial crisis and during the pandemic.

Mortgage rates of 4-5% remain low by historic standards albeit higher than in recent years. Assuming mortgage rates remain at this level, we see UK house price falls remaining in the low single digits for the next 1 to 2 years, below projections for growth in household incomes. This will result in the house price-to-income ratio falling back to levels not seen for a decade. This would certainly set the housing market up for a rebound in activity as consumers become more confident to make large purchase decisions. We expect a rebound in activity in the first half of 2024 as people who have delayed moves while mortgage rates have spiked higher decide to return to the market.

Note: The Zoopla house price index is a repeat sales-based price index, using sold prices, mortgage valuations and data for agreed sales. The index uses more input data than any other and is designed to accurately track the change in pricing for UK housing.

Source: Zoopla House Price Index. Sparklines show last 12 months trend in annual and monthly growth rates – red bars are a negative value – each series has its own axis settings providing a more granular view on price development.

UK house prices increase 1.6% as tariffs, stamp duty changes and broader economic uncertainty dampen buyer demand

House price inflation slows to 1.8% as the supply of homes for sale outpaces the growth in sales agreed

The housing market gets off to its strongest start in three years, with new sales agreed up 12 per cent on 2024.