Search

close

Stay in the loop with our monthly newsletter, bringing you a fresh take on all things property.

Form funnels into a Pardot list to update Prospect sign up for Estate Agent and New Homes

"*" indicates required fields

Annual UK house price inflation

Current ‘over-valuation’ of UK house prices (2024 Q1)

Proportion of expected 2024 housing sales completed or agreed and in pipeline

“The housing market continues to adjust to higher borrowing costs. The summer slowdown is now arriving, tempering activity. The timing of the first cut in the base rate is key and will give a boost to market sentiment and sales activity."

The recent pick up in sales market momentum has continued over June, albeit at a slightly slower pace than the previous 2-3 months. New sales agreed are still running 8% higher than a year ago and other key measures of market activity are also higher year on year.

There are signs that market activity is starting to slow as we approach the quieter summer period. Buyers and sellers who were at the start of the home buying process when the election was called are more likely to have delayed their buying decisions until after the election, adding to the slowdown in activity.

Sales agreed are down slightly month on month across all regions, led by the North East (-6%) and West Midlands (-5%). The overall stock of homes for sale continues to grow across all areas, albeit at a slower rate than recorded over recent months. There are still almost a fifth more homes for sale than a year ago.

Improving sales volumes over H1 2024 has led to a firming in average house prices which is reflected in our house price index. All regions and countries of the UK have registered an increase in house prices on a month-on-month basis since January.

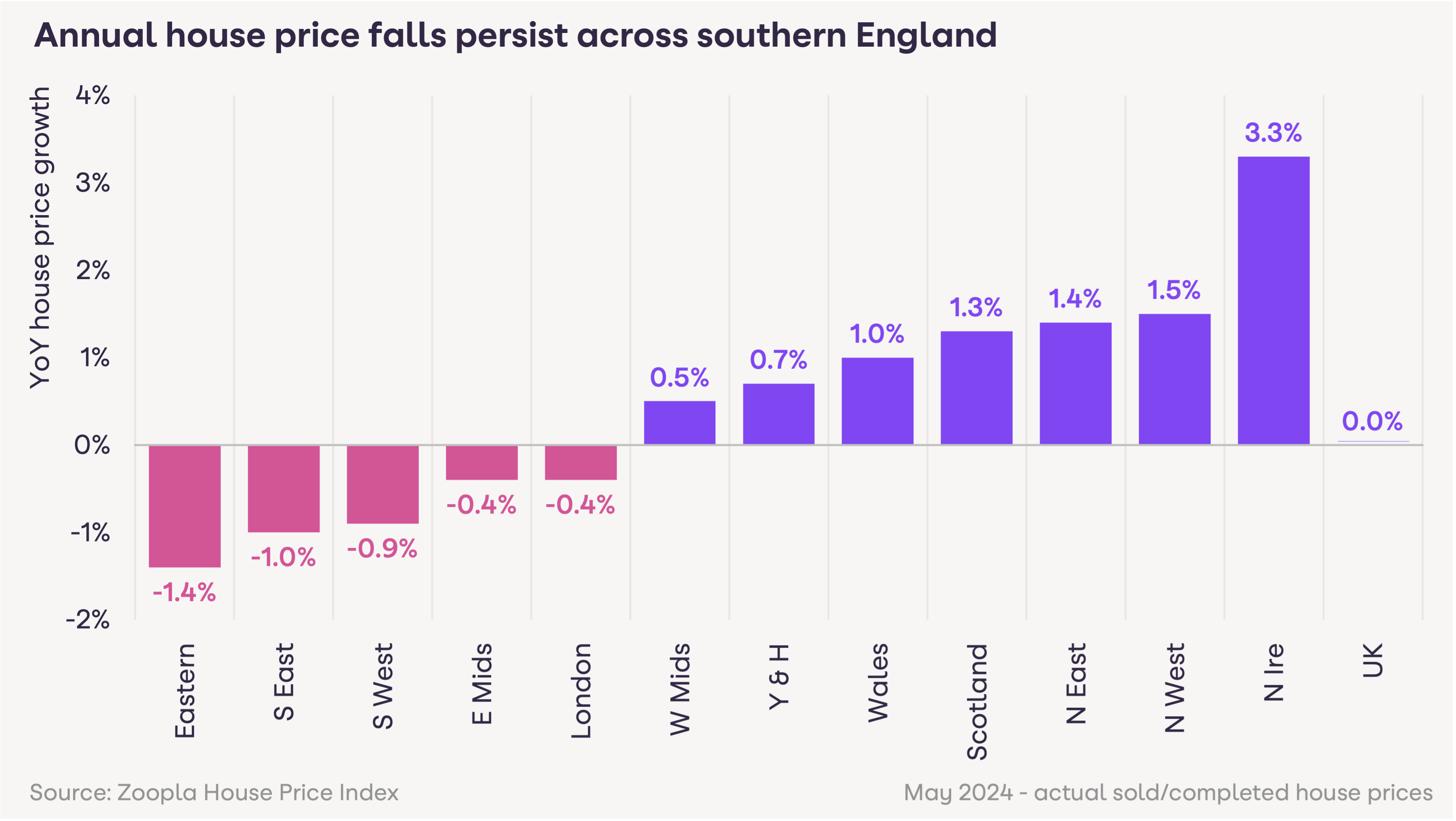

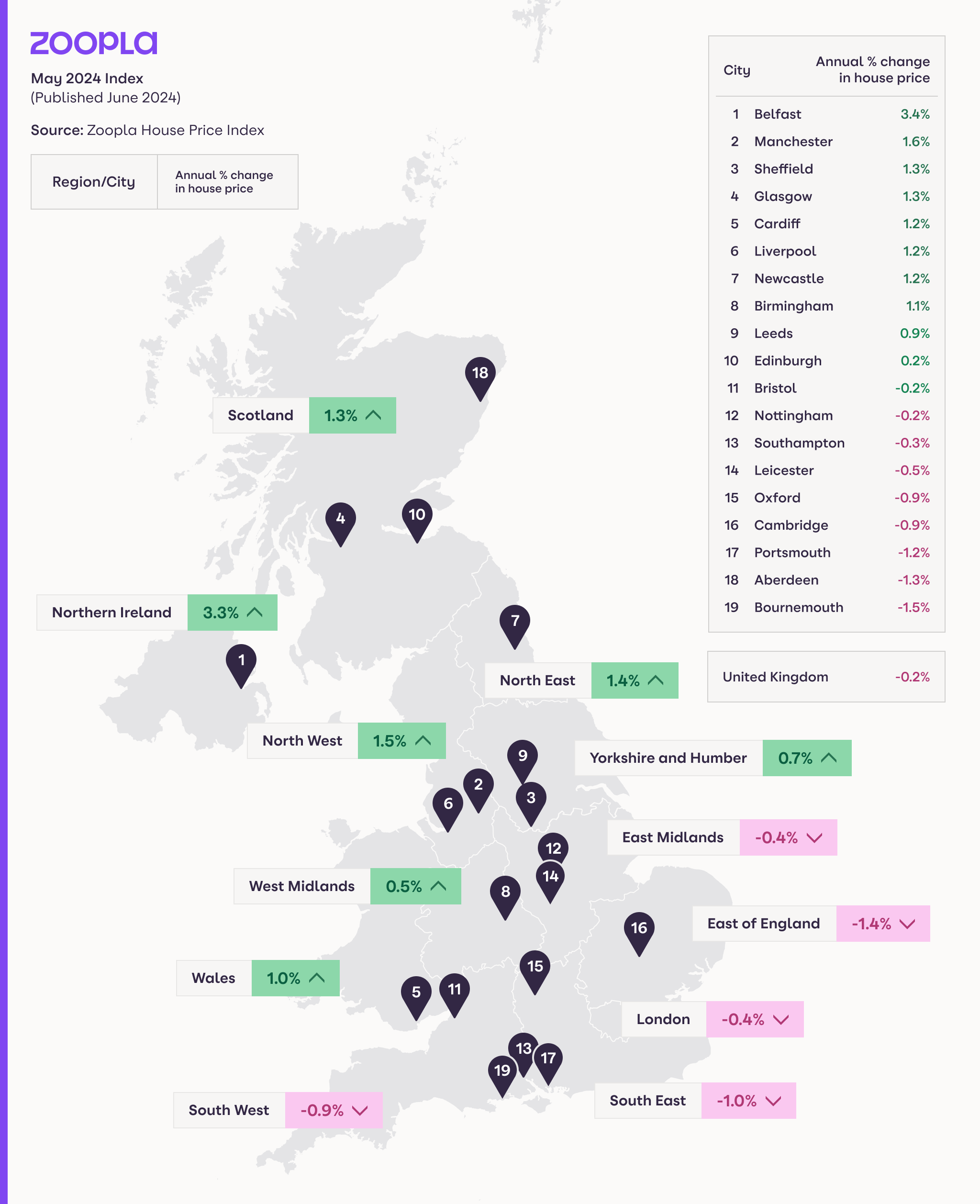

The annual rate of UK house price inflation is now static at 0% in May 2024, up from a low of -1.3% in November 2023 and +1.6% a year ago. House prices continue to register annual price falls across southern England at a slowing rate. Prices continue to increase across the rest of the UK by up to 3.3% in Northern Ireland.

We see no evidence that price rises will pick up speed in the coming months. However, UK house prices are on track to be 1.5% higher at the end of 2024 as consecutive monthly price falls over the last six months of 2023 ‘drop out’ of the annual growth rate.

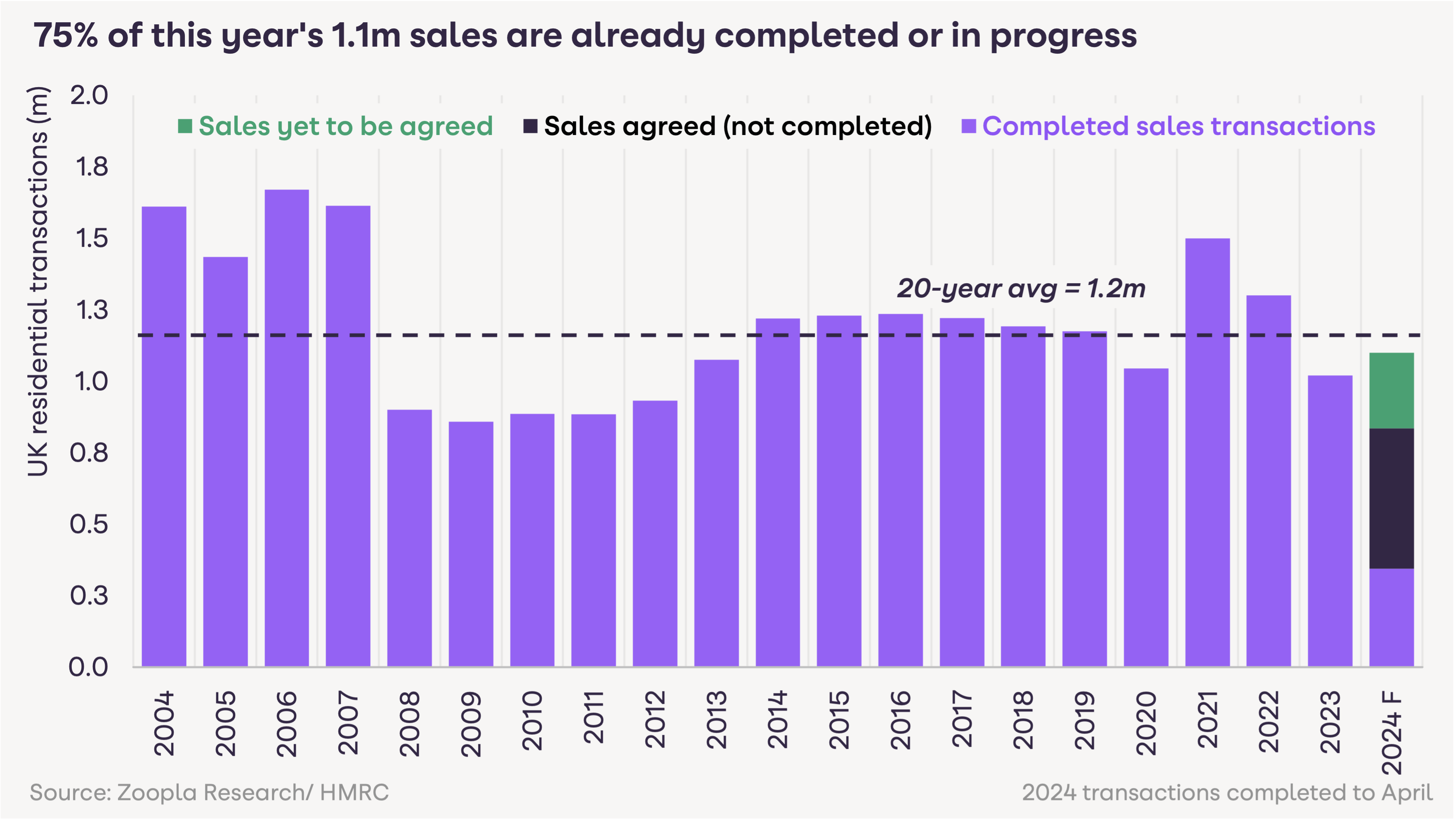

The 4-5 months between a sale being agreed and then completed means we have a good view into the sales pipeline for 2024. Our data shows the market is still on track for 1.1m sales this year.

Three quarters of these 1.1m expected sales have either been completed, or they have been agreed and are working their way toward a completion when the buyer gets the keys and can move in. There are still over a quarter of a million sales yet to be agreed that we expect to complete by the end of 2024.

The 1.1m sales is 10% higher than 2023 but still below the 20-year average. It is positive that sales are rising despite higher borrowing costs and shows more realism on the part of sellers and renewed, cautious confidence amongst buyers.

The housing market has been very resilient over the last year given the rise in mortgage rates.These averaged below 2% in late 2021 and stand at 4.7% today, spiking well over 5% in October 2022 and again over the summer of 2023.

Higher borrowing costs have reduced the buying power of new buyers. Rather than sizable price falls the main impact has been a sharp decline in the number of sales which were 23% lower over 2023.

House prices haven’t fallen as there have been few forced sellers. Unemployment has stayed low by historic standards, and there are a relatively small number of people struggling to pay their mortgage and falling into arrears despite wider cost of living pressures.

House prices still look expensive on various measures of affordability. We expect house price inflation to remain muted, likely to rise more slowly than household incomes over the next 1-2 years.

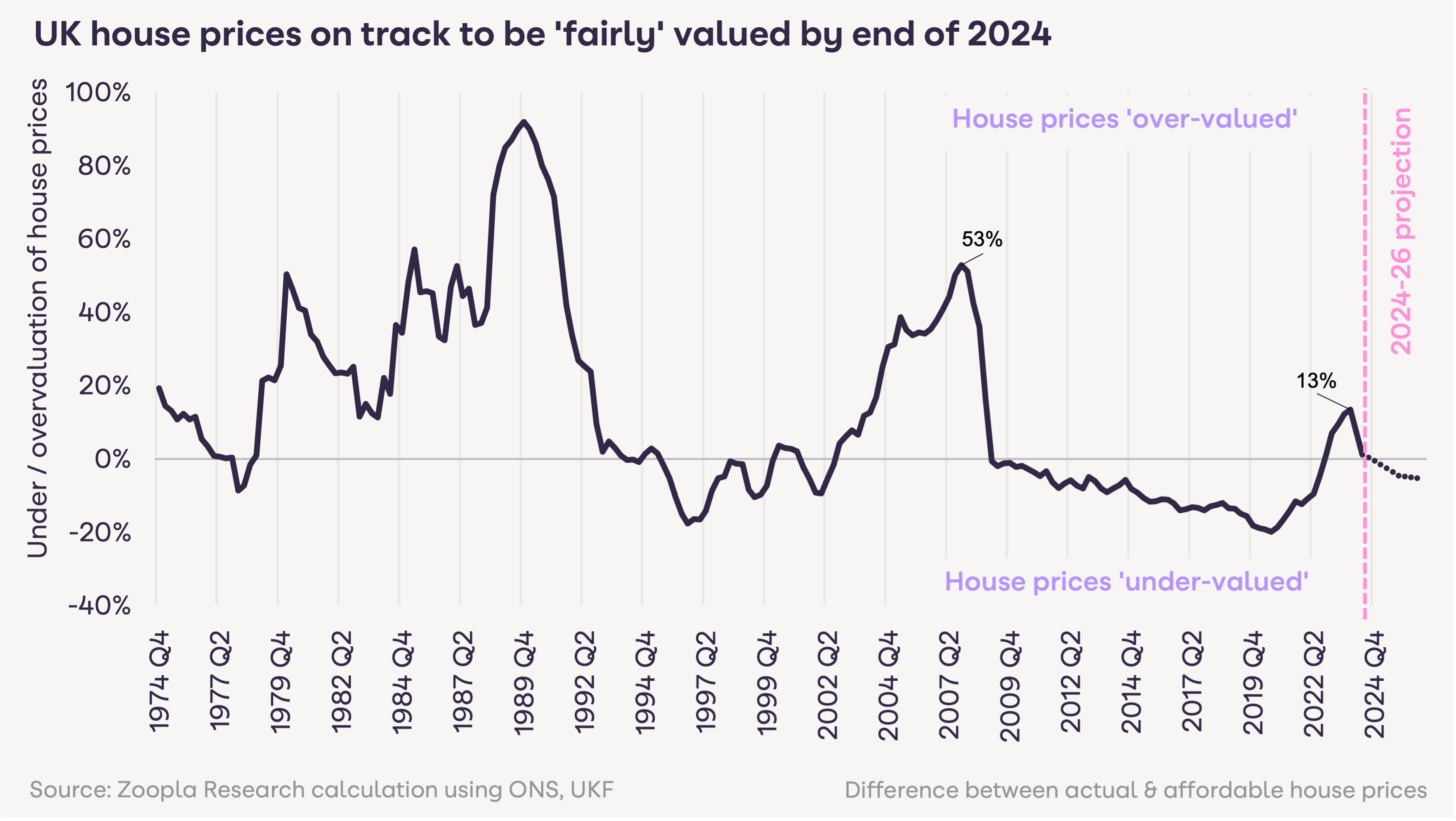

One way we track affordability is to measure the extent to which actual house prices are higher or lower than an ‘affordable house price’ calculated from household incomes and mortgage rates.

The recent jump in mortgage rates led to house prices becoming over-valued by 13% at the end of 2023. This is less severe than in the run up to 2007 (the global financial crisis) and the late 1980’s ‘house price bubble’. Double digit price falls followed both these periods of over-valuation. Price falls have been smaller more recently as the over-valuation was more modest and sales volumes have taken the hit.

Faster wage growth over the last 3 years has boosted household disposable incomes and helped offset some of the impact of higher mortgage rates. Mortgaged buyers have also been taking longer term mortgages to eke out that extra 5%+ of additional buying power.

We estimate that house prices were 8% over-valued at the end of Q1 2024 but by the end of the year this over-valuation will disappear. This assumes house prices rise 1.5% and mortgage rates remain at 4.5%.

Looking ahead, the near-term outlook for the sales market really depends on the outlook for mortgage rates which are a function of the outlook for interest rates. Any reductions in the base rate over the summer and into the autumn will deliver a boost to market sentiment and sales activity, even though the impact on fixed rate mortgages will likely be more muted.

Based on city forecasts for base rates, we expect mortgage rates to remain in the 4-4.5% range going into 2025. This is sufficient to support sales volumes and low, single digit levels of house price inflation. House prices in the south of England are expected to continue to under-perform the UK average as they realign with incomes. Real income growth is the key to supporting sales and demand into 2025.

Source: Zoopla House Price Index. Sparklines show last 12 months trend in annual and monthly growth rates – red bars are a negative value – each series has its own axis settings providing a more granular view on price development.

UK house prices increase 1.6% as tariffs, stamp duty changes and broader economic uncertainty dampen buyer demand

House price inflation slows to 1.8% as the supply of homes for sale outpaces the growth in sales agreed

The housing market gets off to its strongest start in three years, with new sales agreed up 12 per cent on 2024.