Search

close

Stay in the loop with our monthly newsletter, bringing you a fresh take on all things property.

Form funnels into a Pardot list to update Prospect sign up for Estate Agent and New Homes

"*" indicates required fields

Annual UK house price inflation

Year-on-year change in buyer demand

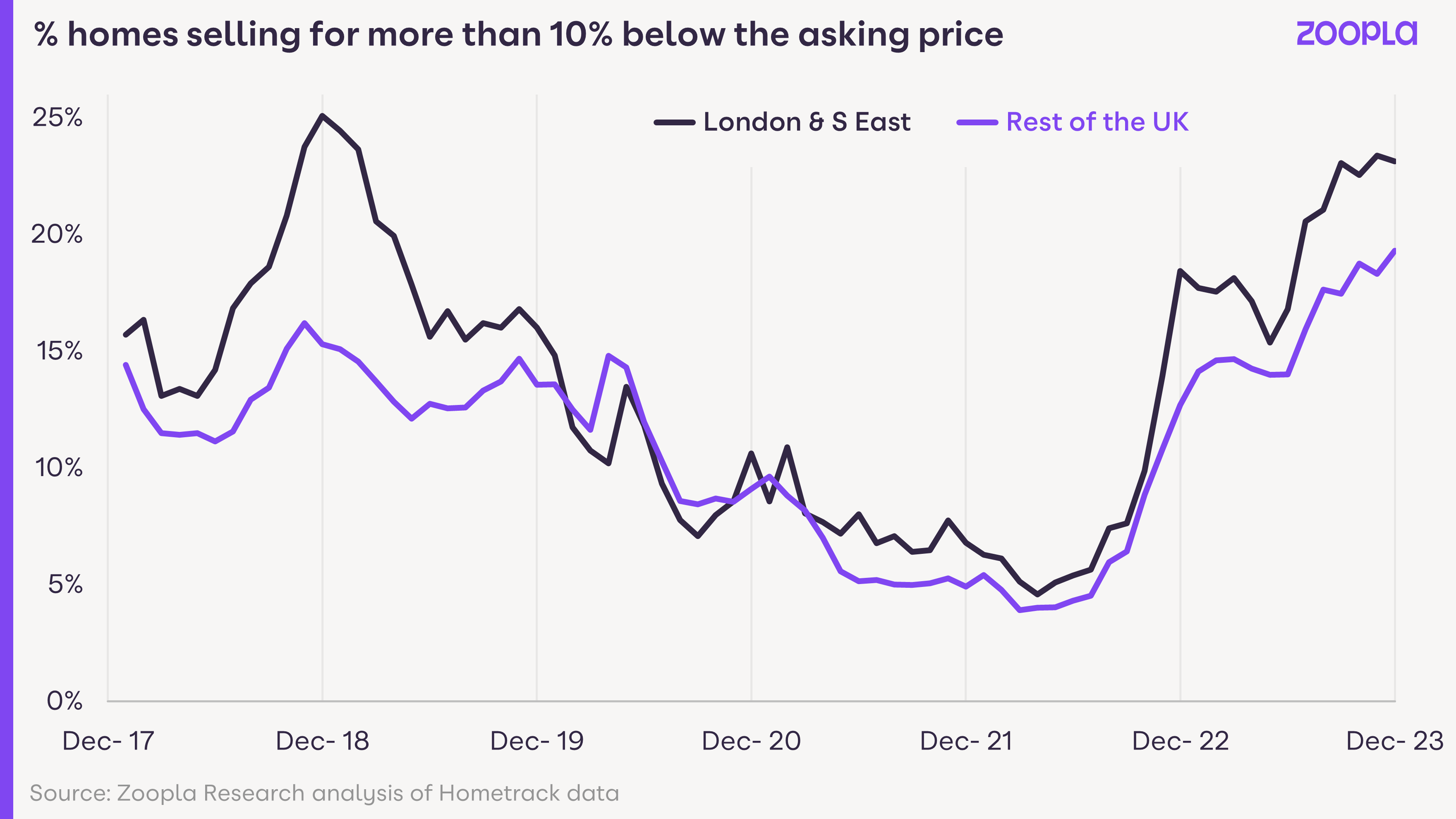

% sales agreed at price more than 10% below the asking price

“It’s a positive start to the year but this is a rebound off a low base. Sub-5% mortgage rates are encouraging but buyers remain price sensitive and focused on value for money. There is upside for sales volumes but prices still need to adjust to allow for reduced buying power.”

Housing demand and sales agreed have registered a strong seasonal rebound over the first three weeks of 2024 as sub-5% mortgage rates support market activity.

Buyer demand is 12% higher than a year ago but remains 13% below the five-year average, which includes the pandemic ‘boom years’ (2021-2022).

It’s a positive start, reflecting a return of pent-up demand following a weak 2023 H2, when many buyers delayed moving decisions in the face of rising mortgage rates.

We reported an increase in sales agreed in the final weeks of 2023 and this trend has continued into 2024. New sales agreed are 13% higher than last year and higher across all countries and regions.

Sales are up the most in Yorkshire and the Humber (+19%) and the West Midlands (+17%). This is evidence that buyers and sellers are becoming more aligned on pricing.

A greater flow of homes listed for sale also indicates that sellers, many of whom are also buyers, feel more confident. Overall supply is 22% higher than last year. The average estate agent has 28 homes for sale, boosting buyers’ choice and keeping prices in check.

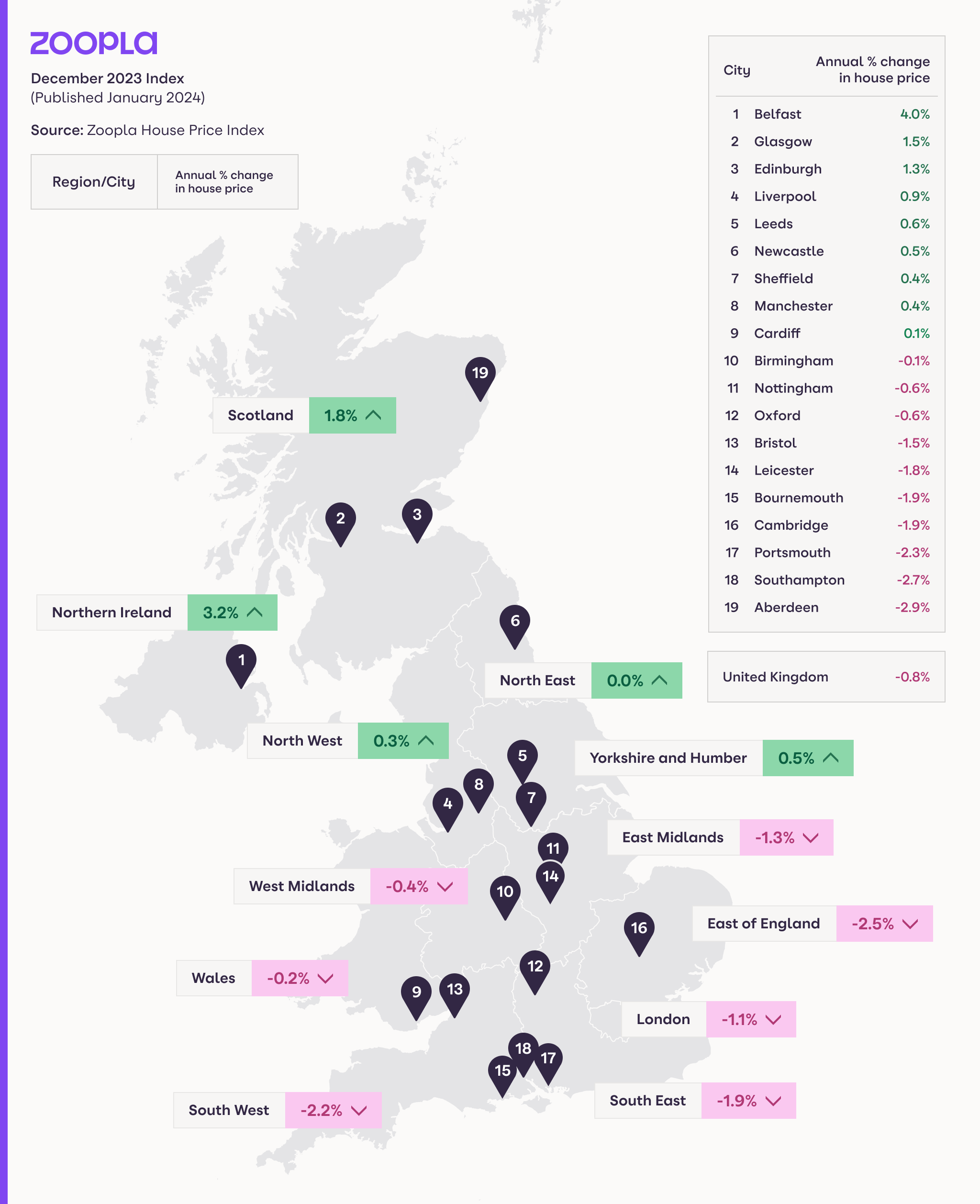

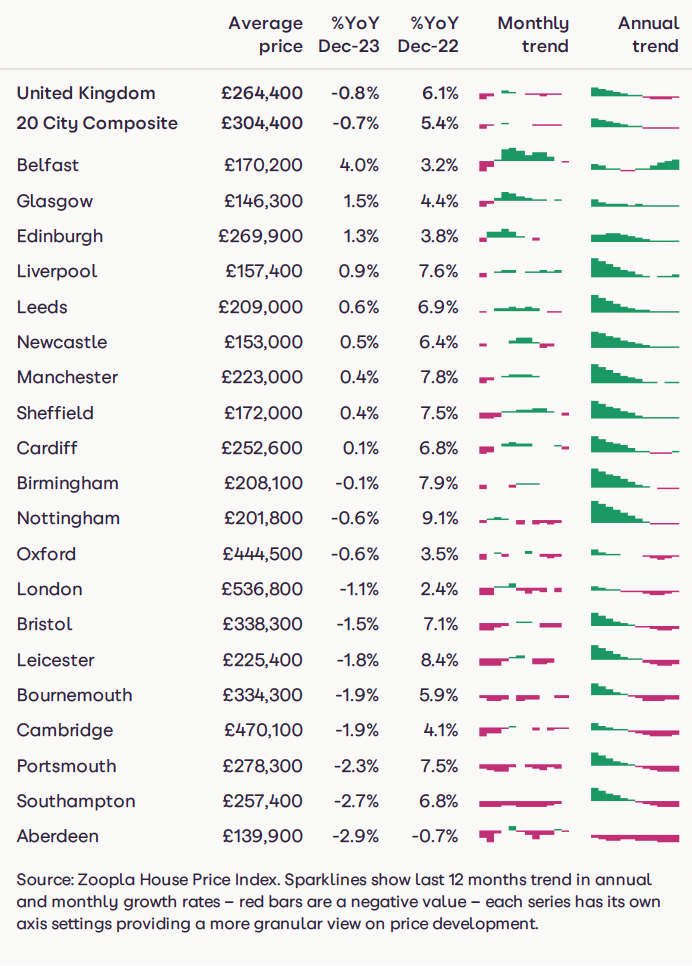

Improving market conditions, in particular more sales, is supporting pricing levels. Our UK house price index recorded annual price falls of -0.8% in December 2023, up from a -1.4% low in October 2023.

House prices continue to adjust to higher mortgage rates through modest price falls. On a regional basis, we register the largest price falls in the East of England (-2.5%) and the South West (-2.2%). Northern Ireland is an outlier with house prices up 3.2% over 2023.

London and the East of England have led the rebound in new buyer demand in the first weeks of 2024. Most other areas recorded below-average increases in demand, typically rising in line with last year or only ahead by single digits.

The rebound in London is uniform across the market segments – inner- London, suburban outer-London and the core commuter areas around London. This could reflect a turn of fortunes for the London housing market. Over the last seven years, the city has lagged behind the rest of the UK in terms of sales volumes and house price inflation.

Our house price index shows that London house prices have risen just 13% since the start of 2016. Meanwhile, they are 34% higher across the UK and almost 50% higher in Wales. The average value of a flat in London is just 2% higher over the same period.

Fast house price appreciation in the early 2010’s saw London reach ‘peak unaffordability’ in 2016 with a price to earnings ratio of over 15x. A succession of factors has subsequently hit demand and pricing in the capital e.g. tax changes aimed at investors and overseas buyers, the Brexit vote, which hit jobs growth and a global pandemic that closed cities to travel and changed working patterns. This, combined with higher mortgage rates which have hit the most expensive housing markets hardest.

Low house price inflation since 2016 and rising earnings means housing affordability in London, measured on a house price to

earnings ratio basis, is at its lowest since 2014. However, London housing prices remain expensive by UK standards at 13x earnings.

Slowly improving housing affordability in London is positive news but home buyers still face a sizable affordability challenge with mortgage rates doubling since 2021. We expect market conditions in London to continue to improve over 2024, with earnings rising faster than house prices. This will continue to improve affordability and support levels of housing sales rather than boost house prices.

The rebound in activity in the first weeks of 2024 is positive news but it’s important not to over-interpret what this might mean for 2024. Mortgage rates fell to 4.2% over Q1 2023, which supported sales volumes and led to firmer pricing and modest price falls over 2023. We expect lower mortgage rates to do the same in 2024 – supporting sales volumes rather than having any impact on prices.

We believe that house prices will be kept in check by several factors. Firstly, a greater supply of homes for sale will provide buyers with more choice, especially for larger family homes.

Secondly, half of those with a mortgage are yet to refinance onto higher rates. This is important as many would-be buyers are upsizers who will need a larger mortgage to move to a bigger home. Higher repayments will ensure buyers remain price sensitive and focused on value for money.

Thirdly, our data shows we are still in a buyers’ market. A small but not insignificant number of sellers continue to cut asking prices to make sure homes attract buyer interest, continuing the trend from 2023. Furthermore, over 1 in 5 sellers are still having to accept more than 10% off the asking price to agree a sale. This is close to 1 in 4 across London and the South-East and rising across the rest of the UK.

Sellers must continue to price realistically if they are serious about moving in 2024. Improved market conditions will boost the chances of a sale, but sellers shouldn’t expect to list at a higher asking price.

The adjustment to higher mortgage rates was always going to take longer than a year, especially given the modest fall in house prices over 2023. Lower mortgage rates are welcome news, but it seems unlikely rates will fall much further in the near term, remaining in the 4-5% range with the best deals for those with big deposits.

This will support more sales rather than price rises in 2024 something businesses should welcome as volumes need to recover from the lows of 2023.

Source: Zoopla House Price Index. Sparklines show last 12 months trend in annual and monthly growth rates – red bars are a negative value – each series has its own axis settings providing a more granular view on price development.

UK house prices increase 1.6% as tariffs, stamp duty changes and broader economic uncertainty dampen buyer demand

House price inflation slows to 1.8% as the supply of homes for sale outpaces the growth in sales agreed

The housing market gets off to its strongest start in three years, with new sales agreed up 12 per cent on 2024.