Search

close

Stay in the loop with our monthly newsletter, bringing you a fresh take on all things property.

Form funnels into a Pardot list to update Prospect sign up for Estate Agent and New Homes

"*" indicates required fields

Annual UK house price inflation.

Gap between asking price and achieved sale price.

Projection for annual UK house price inflation over 2025.

"Sales market activity has rebounded over 2024 as buyers and sellers return to the market. This has boosted sales volumes, but buyers remain price-sensitive, especially in the wake of the Budget and uncertainty over the outlook for mortgage rates in 2025."

Buyers and sellers returned to the housing market in larger numbers over 2024, having delayed moving decisions in the face of higher mortgage rates. More homes for sale and lower mortgage rates has driven a sustained growth in new sales over 2024, with the end of year sales pipeline at its highest for 4 years.

This is positive for the number of home moves, but it is not resulting in faster house price inflation, as affordability remains a constraint on buying power.

Our data shows buyers have become more price-sensitive in the final months of year due to growing uncertainty over the outlook for mortgage rates in 2025 and concerns over the wider impacts of the Budget. It will remain a buyer’s market in 2025, but we expect there to be sufficient house price inflation to support more home moves.

Committed sellers and buyers have continued to agree new deals ahead of stamp duty changes in April 2025, but the window to complete a sale by 31 March 2025 will now be unachievable for most buyers. Sales agreed in the last 4 weeks are 23% higher than last year.

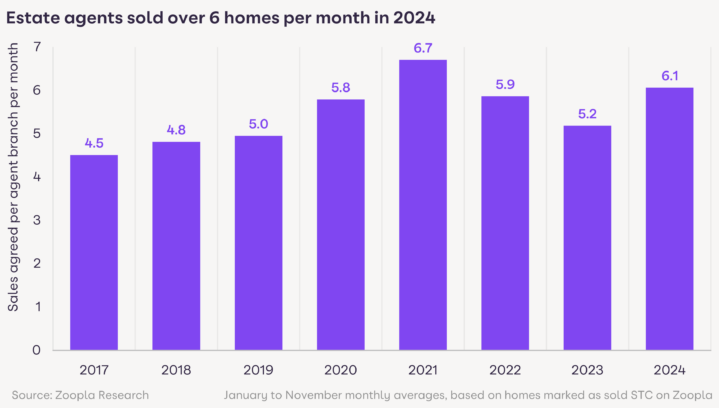

It’s been a stronger year for new sales, thanks to a higher volume of homes being listed for sale, boosting buyer choice. The average estate agent has agreed 6.1 sales per month over the first 11 months of 2024, the highest level since the pandemic boom in 2021.

There is a sizable pipeline of deals that have been agreed and are working their way to completion in the first half of 2025. We estimate this pipeline to comprise of 283,000 homes worth £104bn. This is 27% higher than a year ago by number, and 30% more by value. It’s the biggest end of year sales pipeline by value since December 2020 (£112bn).

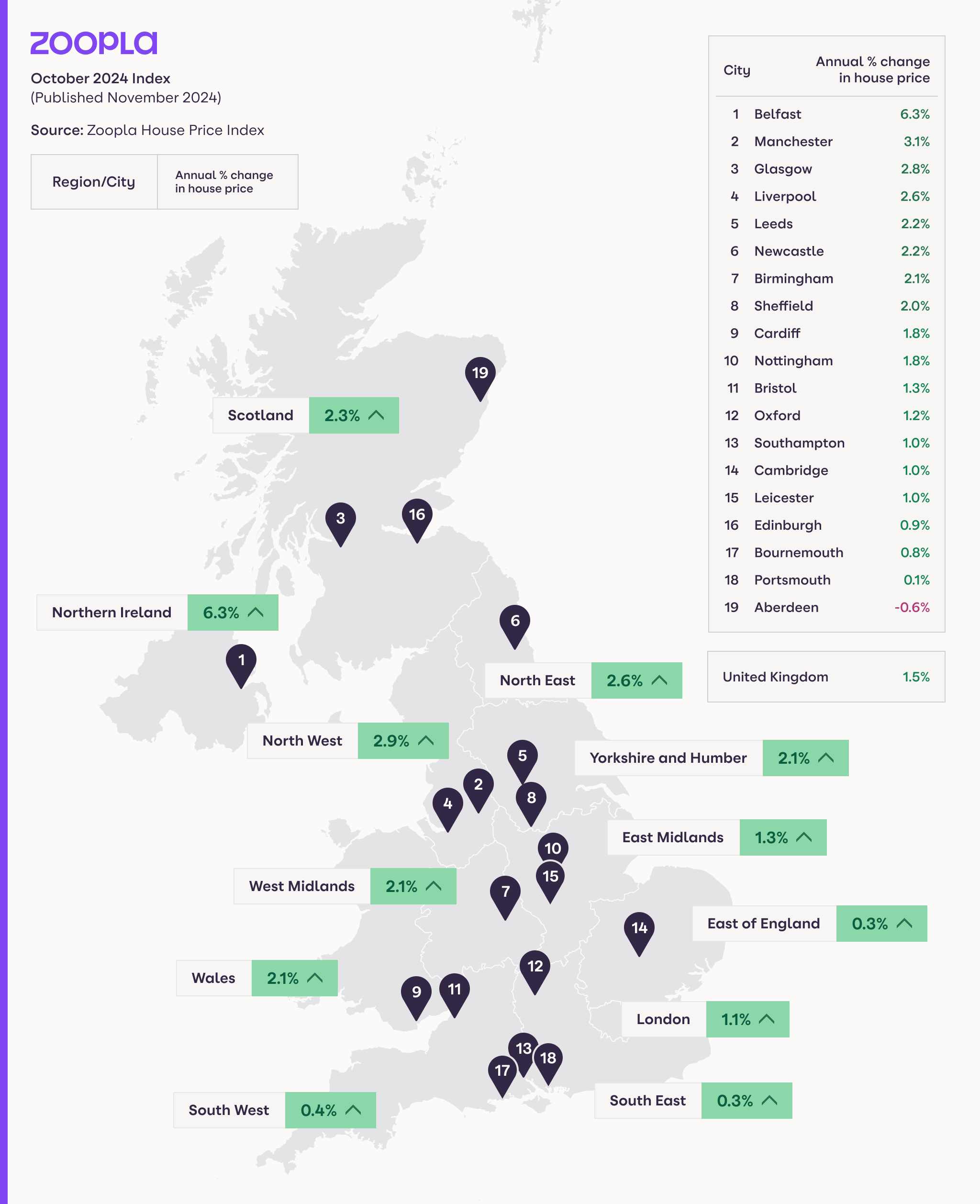

More sales have helped house prices to return to growth in 2024. Annual price inflation was 1.9% in the 12 months to November 2024, compared to -1.2% a year ago. The average house price is £267,500. The South East (0.7%), Eastern (0.8%) and South West (0.9%) regions are recording the lowest levels of price inflation. House prices are rising fastest and rebounding off a low base in Northern Ireland (6.5%). The next highest growth rates are in the North West region (3.5%),followed by the North East (2.8%), Scotland and Wales (2.6%).

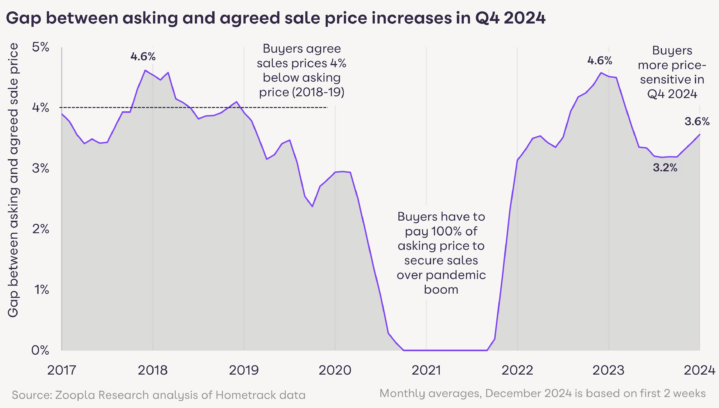

A leading indicator for house price inflation is the size of the gap between the asking price and the agreed sale price. The smaller the gap, the faster prices rise, while the larger the gap the slower prices rise (with the risk of price falls above a certain level).

The pre-pandemic (2018-2019) average sale was agreed at 4% below the asking price and annual house price growth averaged 2% a year. Over the pandemic boom, demand greatly exceeded supply and buyers had to pay 100% of the asking price or higher to secure a sale. UK house price inflation peaked at 10% in April 2022 as a result.

A buyer’s market returned over late 2022 and 2023 as mortgage rates spiked up to 5-6%. The gap between asking and sale prices peaked at 4.6% in late 2023, resulting in modest price falls. Market conditions improved over the first half of 2024 and buyers were willing to pay more of the asking price, resulting in a return to house price growth.

Buyers have become more price-sensitive in recent weeks in the wake of the Autumn Budget and amid growing uncertainty over the outlook for mortgage rates, which have drifted higher. Buyers are currently paying 3.6% below the asking price, compared to 3.2% over the summer, however it remains a buyer’s market. We expect a greater choice of homes for sale and price-sensitive buyers to continue to keep UK price inflation in check over 2025.

We expect UK house prices to increase by 2.5% over 2025, with an ongoing North-South divide resulting in lower price inflation across southern England and faster elsewhere. This is down to the relative affordability of housing across the country and how much house prices have risen relative to household incomes.

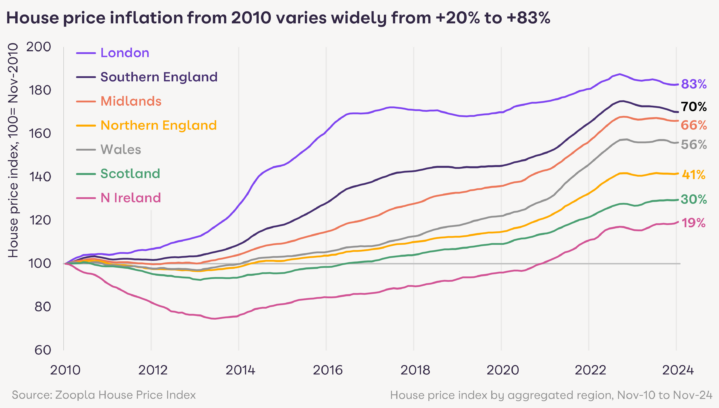

House prices started to recover from 2010 onwards after the downturn of 2008/09. House prices in London have risen by 83% since 2010, followed by 70% across southern regions of England, 66% across the Midlands and 56% in Wales.

At the other end of the spectrum, some area have recorded more modest price increases compared to 2010. Average house prices are just 19% higher in Northern Ireland, 30% higher in Scotland and 41% higher in northern regions of England.

Household incomes have grown by 58% since 2010, meaning there is headroom for house prices to rise in regions where prices have lagged behind income growth and less room for growth in higher-value markets. This is already being reflected in the profile of house price inflation across the UK, and we expect it to continue over 2025.

The outlook for the housing market in 2025 will be dictated by the strength of the economy and labour market as well as the trajectory for mortgage rates, all set within the context of housing affordability.

We believe mortgage rates are set to remain at current levels and buyers are likely to remain price-sensitive in the face of increased uncertainty over the economy and the impact of the Autumn Budget on the jobs market. UK house prices are expected to increase by 2.5% in 2025. However, the desire to move home remains driven by life stage and personal circumstances. We expect 1.15m housing sales to take place over the year in 2025, up from 1.1m in 2024.

Source: Zoopla House Price Index. Sparklines show last 12 months trend in annual and monthly growth rates – red bars are a negative value – each series has its own axis settings providing a more granular view on price development.

UK house prices increase 1.6% as tariffs, stamp duty changes and broader economic uncertainty dampen buyer demand

House price inflation slows to 1.8% as the supply of homes for sale outpaces the growth in sales agreed

The housing market gets off to its strongest start in three years, with new sales agreed up 12 per cent on 2024.